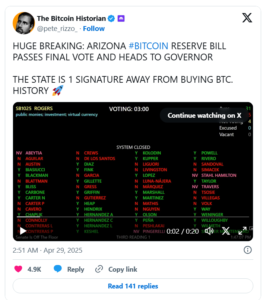

Arizona has made history by becoming the first U.S. state to approve a Bitcoin reserve. This bold move could change the way the state handles its finances in the future. On April 28, the Arizona legislature passed Senate Bills 1025 and 1373. These bills allow the state to invest up to 10% of its $31.5 billion in public funds into digital assets, with Bitcoin as the main focus.

This decision has generated a lot of attention. It shows that Arizona is serious about including cryptocurrency in its financial planning.

Creating a Digital Assets Strategic Reserve Fund

Arizona’s new plan isn’t just about buying Bitcoin. The state will also create a new fund called the Digital Assets Strategic Reserve Fund. This fund will manage any Bitcoin or other digital assets that the state buys or takes control of. This step will help the state stay on top of its crypto investments and ensure they are properly handled.

The fund will operate with strict rules. One important rule is transparency. The state will make sure that every transaction is visible on the blockchain. This will allow the public to see how their tax dollars are being spent. The state wants to avoid the issues that have caused many private crypto investors to lose money in the past.

In addition, the fund will follow strong risk management rules. This is meant to protect the public’s money from the risks tied to the crypto market’s ups and downs. By using these guidelines, Arizona aims to make sure it doesn’t face the same problems that other investors have.

What Arizona’s Bitcoin Reserve Could Mean

If Arizona decides to invest the full 10%, the state could put about $3.14 billion into Bitcoin. At today’s prices, this would mean buying about 31,000 Bitcoin. This would make Arizona one of the largest Bitcoin holders in the U.S. This move could also signal that Bitcoin is becoming a more accepted asset for financial planning.

Treating Bitcoin as a reserve asset could encourage other states to think differently about crypto. If a U.S. state is willing to invest public funds in Bitcoin, other states may follow suit. This could help Bitcoin gain wider acceptance and become a more common part of financial portfolios.

Governor’s Approval Still Needed

Before Arizona’s plan becomes official, it still needs the approval of Governor Katie Hobbs. She has not yet publicly said whether she will sign the bills into law. However, with bipartisan support behind the bills, it seems likely that the governor will approve them.

Once the governor signs the bills, Arizona’s treasurer will be able to start managing the state’s crypto investments. This will be a big moment for the state’s financial future and could set a new precedent for other states to follow.

A Growing Trend in Cryptocurrency Adoption

Arizona’s move is part of a larger trend. Other states, like Texas, Florida, and New Hampshire, are also exploring ways to bring digital assets into their financial strategies. These states are not alone. Many institutions are beginning to treat Bitcoin less like a risky bet and more like a solid investment.

In the past, Bitcoin was seen as a speculative investment. Many people thought it was too volatile and risky to be taken seriously. But now, more institutions and governments are starting to view Bitcoin as a legitimate store of value. If Arizona’s plan succeeds, it could inspire other states to think differently about how they handle digital currencies.

The Bigger Picture

Arizona’s decision reflects a bigger shift happening in the world of finance. As digital assets become more mainstream, they are being treated more like traditional investments. Bitcoin, in particular, is gaining recognition as a valuable asset that can be used to diversify financial portfolios.

Arizona’s move may be the first step in a much larger trend. If successful, it could pave the way for other states to take similar actions. This would help to further integrate Bitcoin and other digital assets into the financial system, providing more opportunities for investors and states alike.

Key Takeaways

-

Arizona’s legislature has approved plans to invest up to 10% of its $31.5 billion in public funds into Bitcoin and other digital assets.

-

The state will create the Digital Assets Strategic Reserve Fund to manage these investments, ensuring full transparency and risk management.

-

Arizona could invest around $3.14 billion into Bitcoin, buying approximately 31,000 BTC.

-

Governor Katie Hobbs must sign the bills for the plan to move forward, but bipartisan support suggests strong chances of approval.

-

Arizona’s decision highlights a growing trend of states and institutions recognizing Bitcoin as a legitimate reserve asset.

Author

-

Tanjid Osman is a crypto journalist and writer with a keen focus on blockchain technology and digital assets. At CryptoTalk.News, he delivers in-depth market analysis, price predictions, and insights into emerging trends. Known for simplifying complex crypto topics, Tanjid empowers readers to make informed decisions in the ever-evolving digital economy.

View all posts